taxes to go up in 2021

Overall countywide property tax collections for the 2021 tax year are 66 billion an increase of 256 million from the previous year of 63 billion. For family coverage the out-of-pocket expense limit is 8750 for tax year 2021 an increase of 100 from tax year 2020.

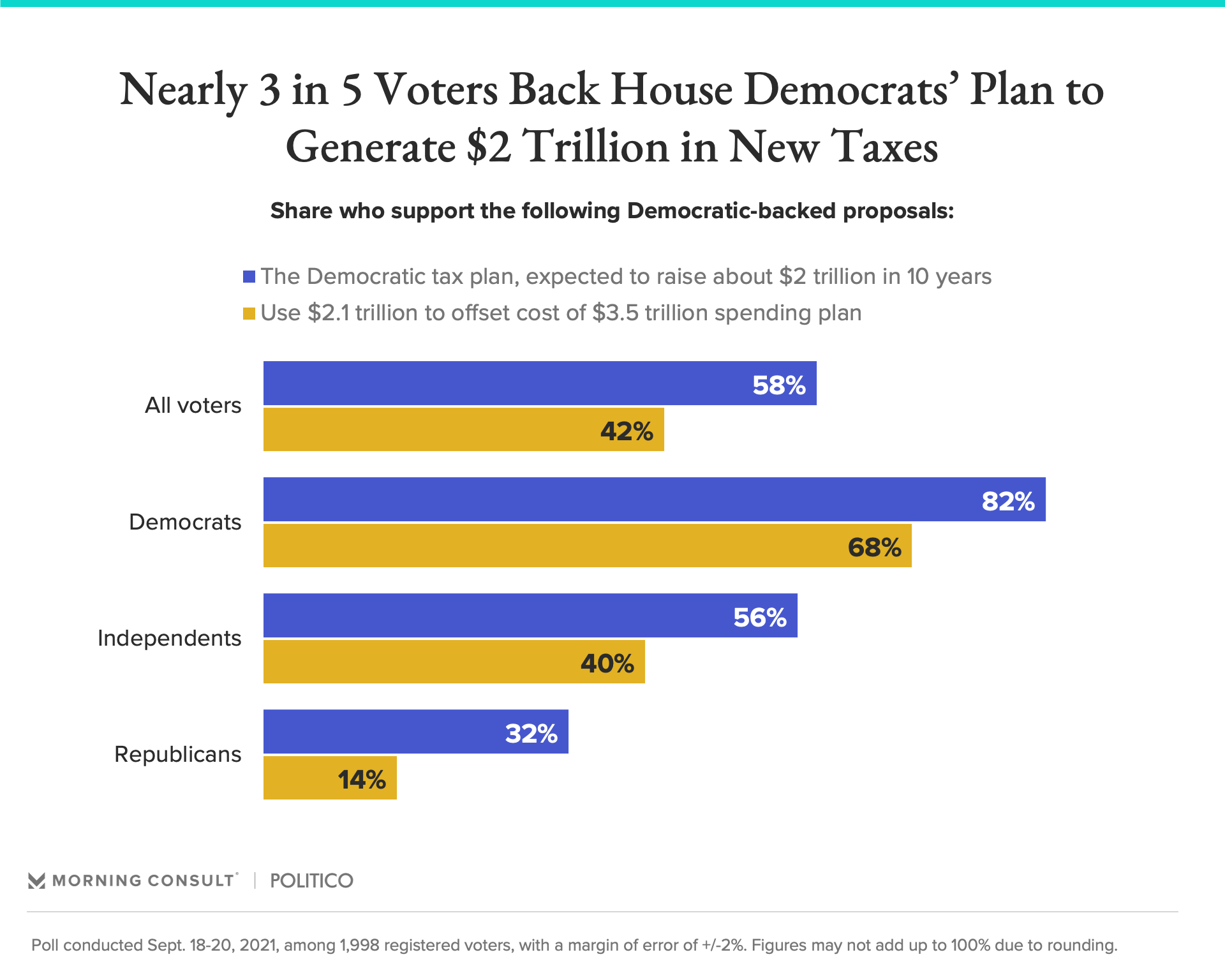

How House Democrats Plan To Raise 2 9 Trillion For A Safety Net The New York Times

Almost all of the individual tax cuts do expire at the end of 2025 unless Congress extends them.

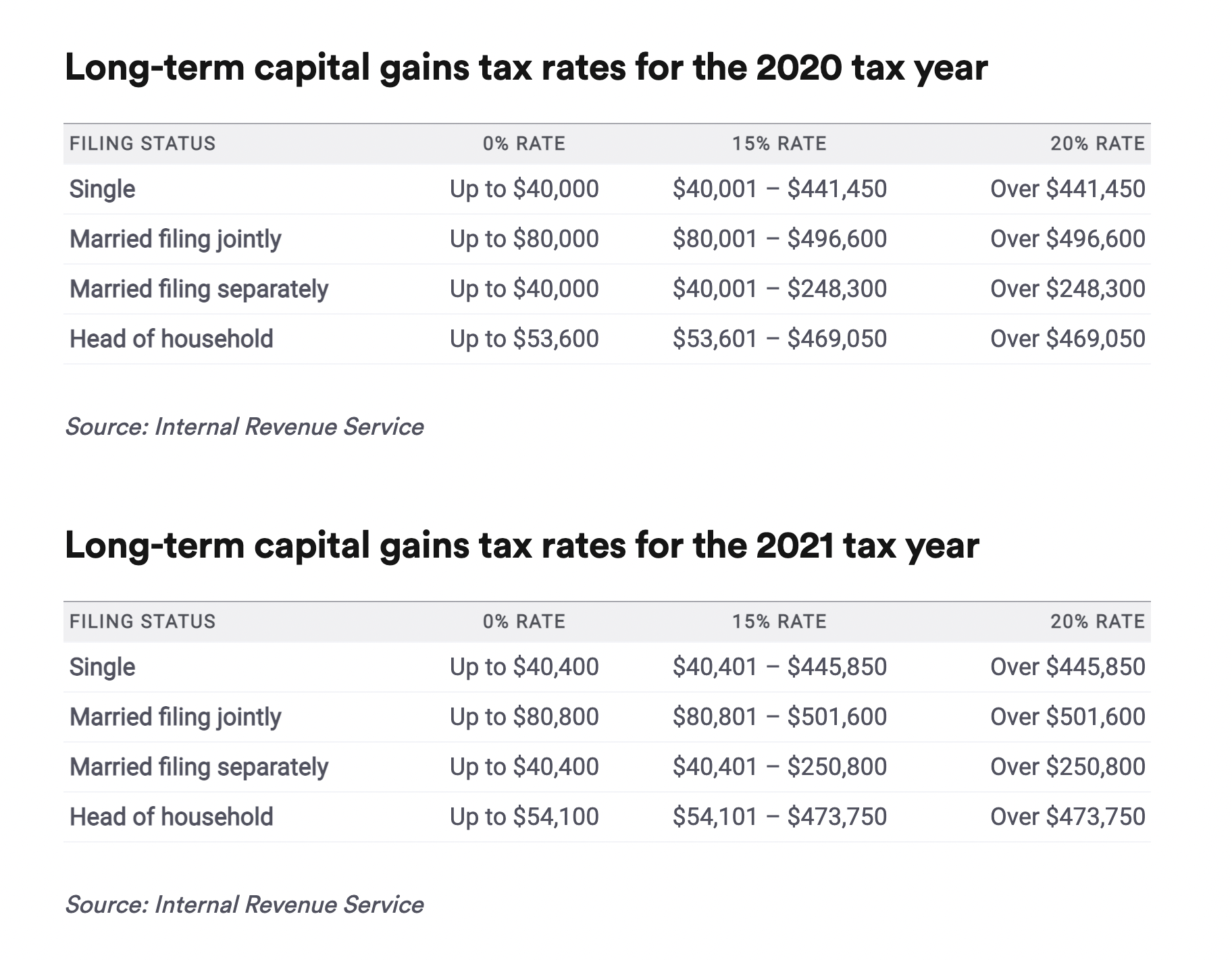

. You cant run a 10 to 15 deficit forever he said. New Tax Rates Local Tax Rate Changes There are no local tax rates increase for tax year 2021 however two counties St Marys and Washingtons have decreased their local. 41675 for married couples filing separately.

All told the changes would be modest in terms of revenue Jim calculates. He also told the Wall Street Journal the obvious thing. For tax year 2021 the adjusted gross income amount.

100 Free Tax Filing. Prepare federal and state income taxes online. For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022.

2021 tax preparation software. 2021 Alternative Minimum Tax Exemption s. That means if you make the same salary you might be in a lower tax bracket in 2022.

Barbara Weltman author of JK. The standard deduction for 2021 increased to 12550 for single filers and 25100 for married. Your capital gains rate is 0 for the 2022 tax year provided your income does not exceed.

Were going to have to pay for it. The car shortage has caused a domino effect finally falling on Virginians tax bills. Taxes are going to have to go up.

That means the old higher tax rates would return including the top rate of. The IRS sent interest payments to individual taxpayers who timely filed their 2019 federal income tax returns and received refunds. The Joint Committee on Taxation released a chart indicating that federal taxes for those making between 10000 and 30000 would actually go up starting in 2021.

Lassers 1001 Deductions Tax Breaks 2021 says the government also adjusted the standard deduction amounts for 2020. The used car shortage will make some Virginians personal property taxes go up. The big tax deadline for all federal tax returns and payments is April 18 2022.

83350 for married couples filing jointly. Efile your tax return directly to the IRS. After 11302022 TurboTax Live Full Service customers will be able to.

We provide authorized IRS e-File software to help file your tax return. How King Countys revenue. Most interest payments were received.

Cuts for families making less than 400000 a year are likely to stick around. For example if you are a single taxpayer who makes 41000 per year you were in the 22.

Crypto Tax 2021 A Complete Us Guide Coindesk

Tax Season 2022 Tips For A Speedy Refund And How To Avoid Gumming Up The Works The Seattle Times

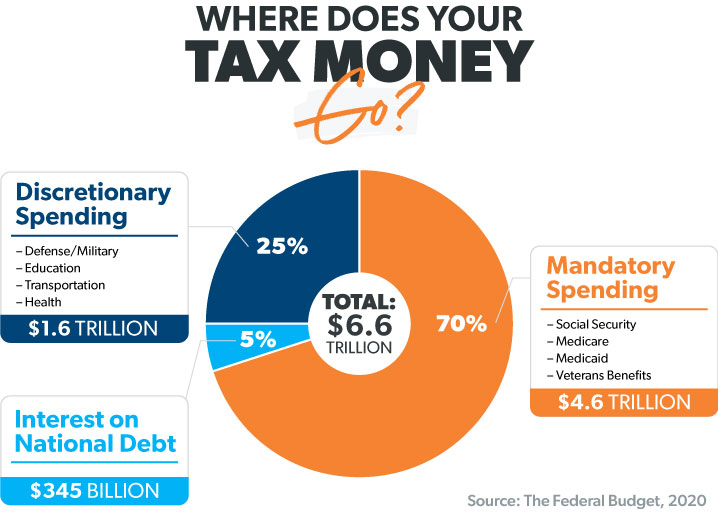

What Do Your Taxes Pay For Ramsey

Rising Payroll Taxes Coming To Shore Up California S Pandemic Depleted Ui Fund Calchamber Alert

Here S How Rising Inflation May Affect Your 2021 Tax Bill

Got Tax Bill Didn T Go Up Much Am I Crazy That Your Taxes Are Going Up 164 In Denver County Colorado Hard Money Lender

Left Wing Study Middle Class Will See Taxes Go Up Under Biden S Plan Americans For Tax Reform

2021 Taxes 8 Things You Need To Know About Ffccu

Will Cap Gain Tax Hikes Burst The Stock Bubble Thestockbubble Com

Are Taxes Are Going Up Next Year

Why Your Portland Property Taxes Climbed This Much You Voted For It Oregonlive Com

Here S A Guide To File Your 2021 Tax Returns Wfaa Com

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

2022 Tax Guide How To File Your 2021 Taxes

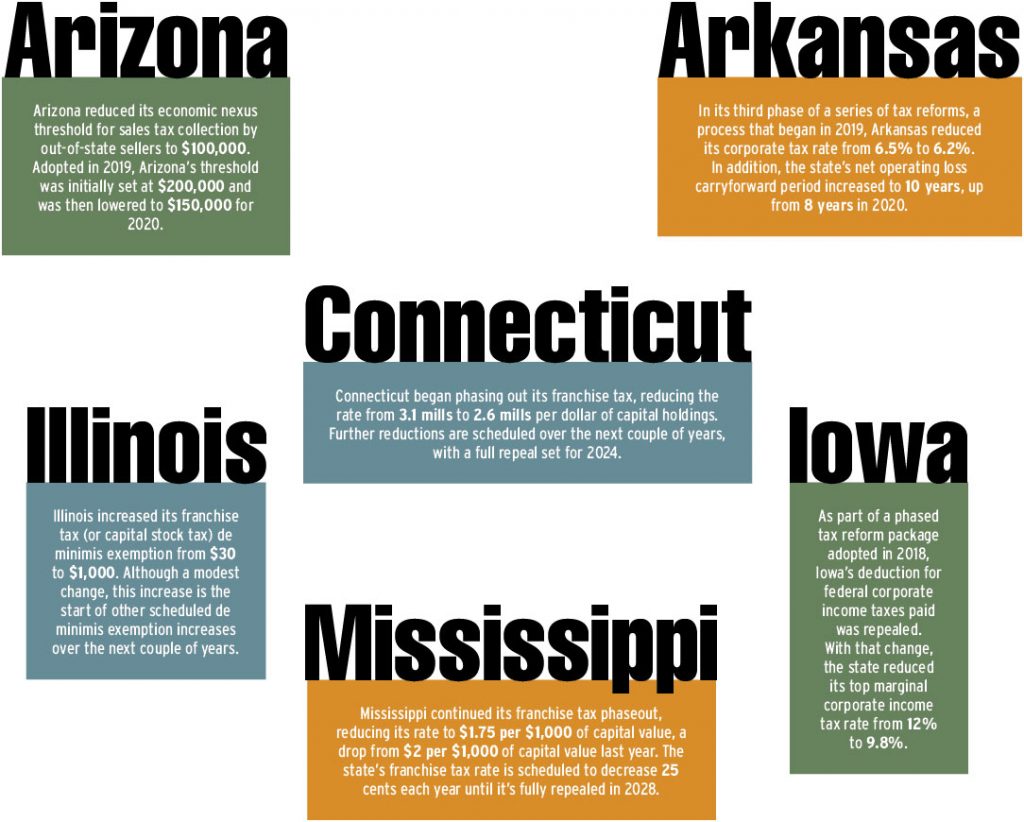

State Tax Updates In 2021 Tax Executive

Rachel Wolf On Twitter 1 People Think Taxes Will Go Up To Pay For The Pandemic But They Re Not Expecting Them To Go Up This Year Https T Co Hyu863llcm Twitter

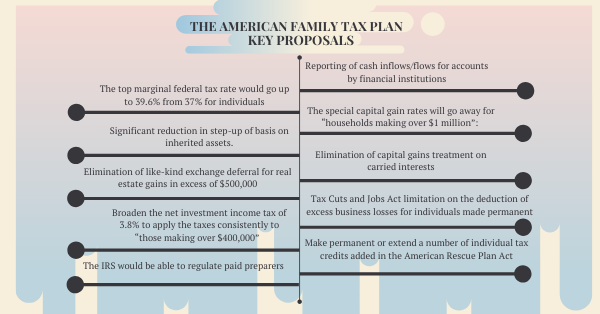

The American Family Tax Plan Nstp

Are Taxes Going Up Trusttree Financial

The Tax Man Cometh For The Wealthy Corporations In House Democrats Plan